There’s a reason you can afford that special family vacation, and for most, it’s because you saved your pennies. So while you make take your kids around the world in grand fashion, it’s never too early to learn the value of money. Remember those piggy banks you had as a kid? Well today’s apps that teach kids financial literacy are way more sophisticated. It’s the start of the year, and if you’re not on an app already, we have the top 4 apps for you. These apps and websites to teach your kids to save, invest, charitably give, and treat themselves, too. It’s never too early to teach kids financial literacy.

Contributor: Marie Koch Williams

The App: BusyKid

What you can do:

Forget the chore chart, chore jar and manual allowance systems. BusyKid allows you to streamline and tracks and automates this all for you. On BusyKid, you can assign chores, exercise, reading time, etc. to each kid and assign suggested compensation. At the end of the week, you verify that chores were actually done, and you can approve “payroll”, and all on the app.

Once your kids are paid, it’s not a free for all either. This is where the financial literacy comes into play. You can pre-determine the percentage split among “Save”, “Spend”, and “Share”. You can also set up a savings match of 50 cents on every dollar saved. It’s similar in concept to a 401k, so they get into a good habit of allocating more of their funds to savings. But it’s not all save; life is about balance. For the “Spend” on BusyKid, there’s a debit card that allows your kids to make their own purchases. Just like a real adult. Additionally, there are about 19+ charities that you kids can donate to through the app. Charities include Toys for Tots and the Special Olympics.

The other cool tool is in the next app, Stockpile. On Stockpile, your kids interested in the market can take their save bucket and invest it in stocks. Whether or not your kids end up in finance, understanding the stock market is always a useful skill.

The cost:

It’s $3.99/monthly to start, and you can get 20% off if you pay annually.

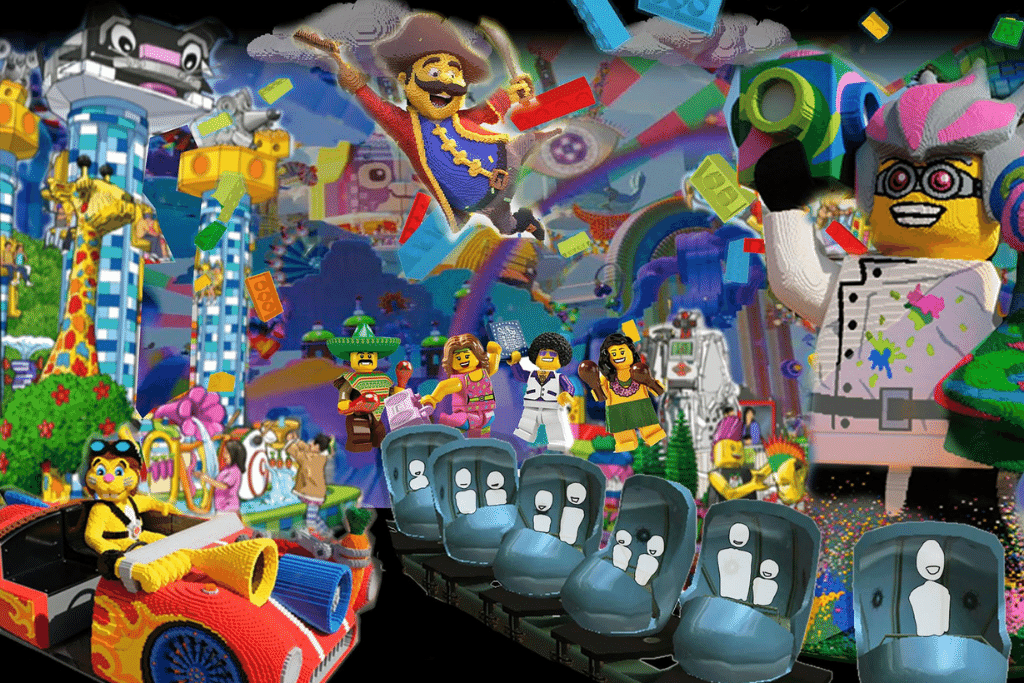

The App: Stockpile

Stockpile is the app that teaches kids financial literacy through the stock market. Stockpile allows minors to hold portfolios and shares of stock. It’s a real-life introduction to the stock market for your children. Stockpile allows your children to invest in a selection of stocks, and it interfaces with BusyKid. So your kids can transfer a portion of their savings into stock, that is administered through Stockpile. They can do the research themselves on the companies, and make their own decisions of how to allocate those savings in the market. We’re not talking Crypto here; these are set blue chip type stocks that generally won’t have massive swings.

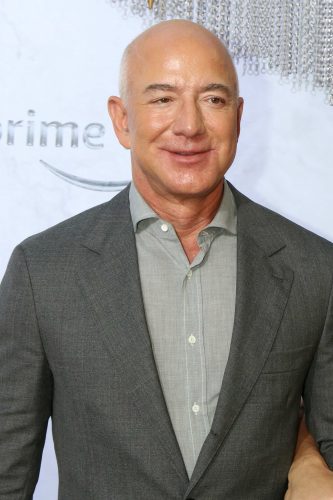

Those balances are then visible and manageable to buy and sell in Stockpile. Before you wonder how that babysitting money is going to buy a share of Amazon, the app allows fractional share purchases. This means stocks like Apple, Amazon, Starbucks and Costco are within reach. As a parent, it’s pretty cool to see the stocks choose, and see them experience first-hand the growth of their portfolios through appreciation dividends.